25+ Va funding fee calculator

Youll pay a higher funding fee if you plan to put down less than 5 on the home purchase. 05 percent for the VA Streamline Refinance.

How To Open A Paypal Account Step By Step Guide For 2021 Autods

If you take out a second VA loan the funding fee is something to keep in mind.

. Over the phone using our automated system - FREE. Application Fee Processing the application has a fee of 350. Some borrowers can have their VA funding fee waived including those with service-connected disabilities and those who have.

Youre required to pay a VA loan funding fee between 1436 of the loan amount as of 2020. And VA lenders. Title insurance can range from 05 - 1 of the home price our calculator assumes 05.

A VA loan co-signer can help you qualify. Welcome to New American Fundings Manage My Loan page where you can make payments view your loan information and more. Funding fees for a second VA loan.

The calculator also allows the user to select from debt-to-income ratios between 10 to 50 in increments of 5. Use this calculator to calculate your VA Max Mortgage from your remaining VA Entitlement also called VA Loan Second-Tier Entitlement and see if you will need a down payment. This fee may be negotiable.

Now if youre a disabled veteran with a service-connected disability rating of 10 or higher you are exempt from the VA home loan funding fee. Get a VA loan quote. The standard VA loan limit in 2022 is 647200 for most US.

7 On a 300000 loan that fee can be anywhere from 420010800. Vocational Rehabilitation and Employment. Credit Report Loan Application.

The fee is determined by the loan amount your service history and other factors. Note 4 VA loans require a one-time fee called a VA funding fee which may be collected at closing or rolled into your loan. There is no fee for this service.

About VA Loan Limits. VA loan limits received a massive increase in 2022. If the home you are buying is more than your remaining entitlement allows you can still use a VA loan if you put down 25 of the difference of the purchase price and maximum loan amount.

Most lenders offer VA loans with 10- 15- 20- 25- or 30-year terms with fixed or adjustable rates. Credit Report Fee The lender uses this fee to obtain your credit report. Note 3 VA loans require a one-time fee called a VA funding fee which may be collected at closing or rolled into your loan.

You can pay your funding fee in one of two ways. Rates quoted require a loan origination fee of 100 which may be waived for a 025. In general funding fees range from 05 to 36 for refinance loans and 125 to 36 for purchase loans.

And the fee is usually included in the loan so it increases your monthly payment and adds to the interest you pay over the life of the loan. VA Home Loan Funding Fee Waiver for Disabled Veterans. NOT the purchase price of the home.

This fee is rather easy to waive given how small it is relative to. Select the Funding Fee Select fee 000 100 125 140 165 230 360. And 23-36 percent for a VA cash-out refinance.

By including it in your loan or in full at your closing. Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. Counties increasing from 548250 in 2021.

VA loans generally do not consider front-end ratios of applicants but require funding fees. Helpful VA Loan Links. Minimum credit scores start between 580 and 640.

The fee is determined by the loan amount your service history and other factors. VA loans are backed by the Department of Veterans Affairs and offer exclusive mortgage benefits to eligible servicemembers veterans and their spouses. VA Loan Payment Calculator.

VA home loans have relatively lenient requirements. VA Funding Fee Chart. Currently veterans will pay a 36 funding fee when using a VA loan for the second time with a down payment of less than 5.

Freddie Mac VA and HUD require lenders to ensure that borrowers maintain adequate homeowners insurance on homes that secure. Homeowners can pay an upfront sum to lock in a lower rate of interest if they know they will be living in a house for an extended period of time. Loans are subject to an additional funding fee which may be financed up to the maximum loan amount.

VA funding fee is an added cost. USDA Mortgage Loan Calculator. A down payment on your VA loan may be required in certain circumstances and maximum loan limits vary by county.

Disabled veterans can check eligibility requirements HERE. The current VA funding fee is 23 percent of the loan amount for first-time home buyers with zero down. Theres no down payment required.

It costs about 25. This mortgage calculator is intended to assist.

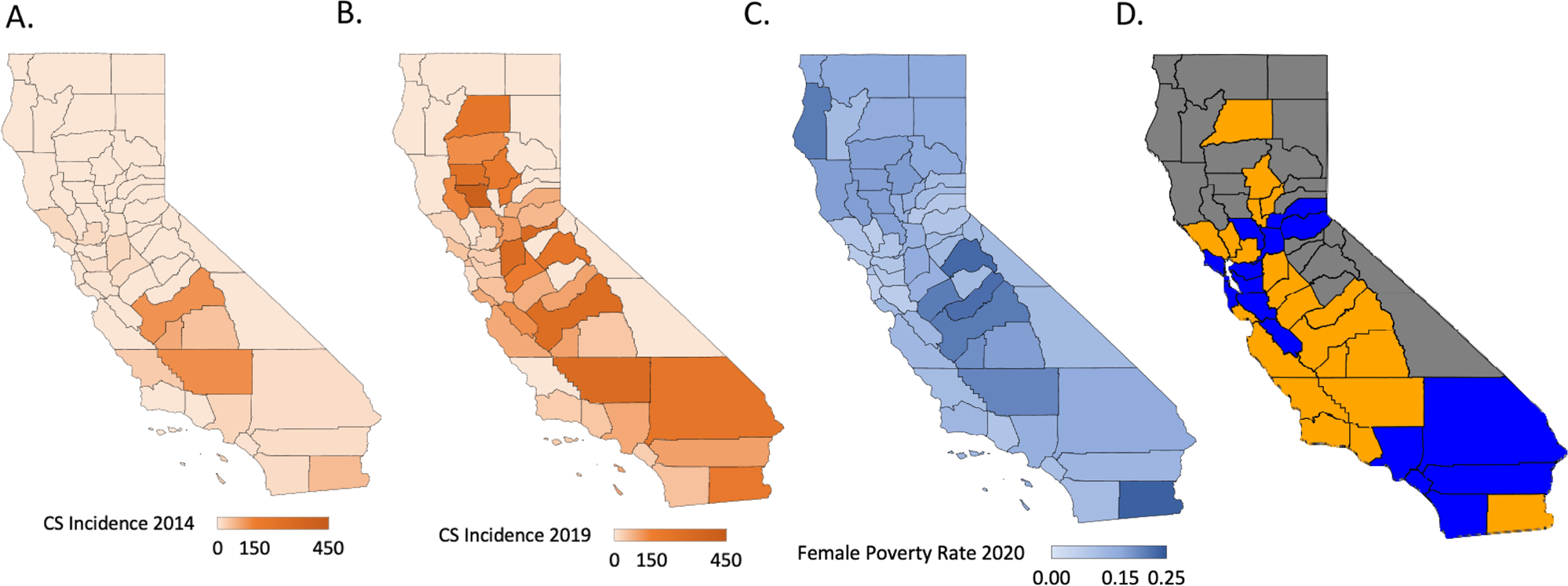

Examining Associations In Congenital Syphilis Infection And Socioeconomic Factors Between California S Small To Medium And Large Metro Counties Journal Of Perinatology

2

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Mortgage Loans Va Loan Refinance Mortgage

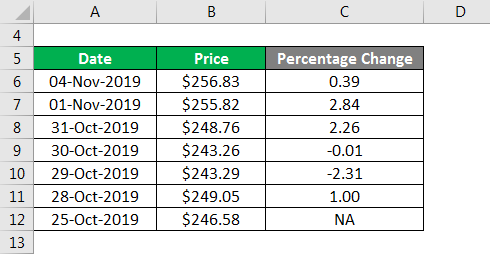

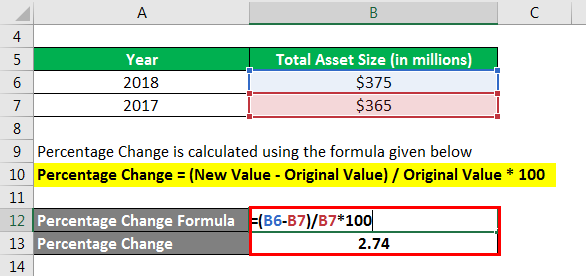

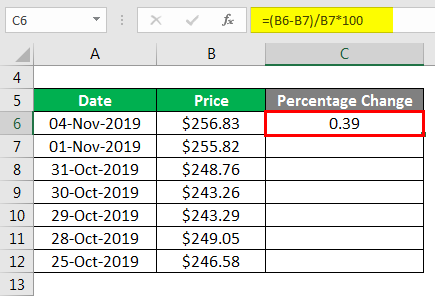

Percentage Change Formula Calculator Example With Excel Template

Va Home Loan Refined Lending

Pin On Finance And Mortgage Tips

Percentage Change Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Va Funding Fee Table Refinance Mortgage Home Improvement Loans Home Loans

Kentucky Va Mortgage Loan Information Va Mortgage Loans Mortgage Lenders Refinance Loans

Va Home Loan Refined Lending

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

Member Spotlight

2

Va Home Loan Refined Lending

Percentage Change Formula Calculator Example With Excel Template

2