The money calculator car depreciation

Buy a car for 10000 and it might cost you 2000year in deprecation and be worth around 4000 after three years but spend 50000 and the bill for depreciation will be more like 10000 per year. Down PaymentDrive-Off FeeCapitalized Cost Reduction a sum of money you pay upfront toward the value of your car.

Depreciation Calculator Definition Formula

The overall brand rankings are just below.

. Car Depreciation Calculator. Estimate your monthly lease payment by using our car lease payment calculator. Where A is the value of the car after n years D is the depreciation amount P is the.

If you leave the Depreciation period field empty the car. Finding out how much money it will cost to lease a new car truck or SUV is quick and easy with our lease calculator. These are the most popular used car models in the market now.

The calculator will estimate the capitalized cost lease price residual value the depreciation and lease fees the monthly payment without taxes and the monthly payment after the tax is applied. When it comes to expense the. A lease with a.

We typically show the. How to Calculate a Lease. How to Calculate Depreciation Using Kelly Blue Book.

Heres a workaround if you want to focus on your cars resale value rather than its value as a wasting asset. Below is the explanation of the values that are required to add to the calculator for calculation. Depreciation Used Car Finder.

For example if you have an asset that has a total worth of 10000 and it has a depreciation of 10 per year then at the end of the first year the total worth of the asset is 9000. This total car cost calculator will not only calculate the annual monthly and per mile cost of buying owning and operating an automobile but it will also allow you to calculate those costs side-by-side with a second car buying scenario. Depreciation Calculator Insurance Quote Comparison Loan Calculator.

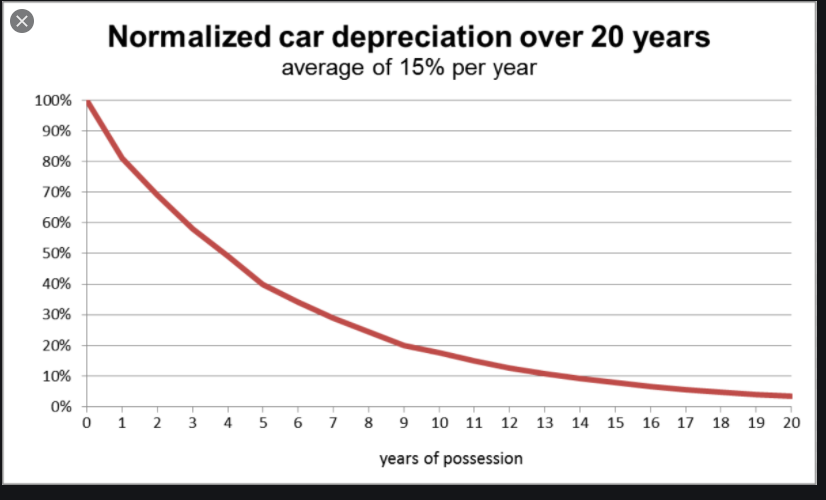

A P 1 - R100 n. A car that doesnt depreciate as much will save you more money than one that costs a little less to fill up and lasts longer between refuels. 28 20 16 8 6 5 4 3 2 1 for all subsequent years after the nineth year.

Find car models by depreciation using the search bar above. The longer you own the car the lower will be the average annual cost of depreciation. After paying income taxes on a 53924 salary the take-home pay is reduced to 43422.

Asset value - The original value of the asset for which you are calculating depreciation. Period - The estimated useful life span or life expectancy of an asset. Saving some money each month makes car B more attractive but its higher down payment makes its total lease cost almost 1000 more than Car.

Car A has a 36-month lease with monthly payments of 200 and 1500 down. With the help of a carvehicle insurance premium calculator to save money and get instant car quotes at the time of renewal. Save time money with real advice from auto.

This calculator will help you to estimate the cost of owning and operating your car. Accessories - Depreciation cost on the accessories of a car is also computed while determining the amount of IDV. Car Loan Factors Explained.

We publish current Redmond auto loan rates for new used vehicles. Operating cost calculator helps drivers estimate the amount of money required to keep. Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

Financial caution Using the Car Depreciation calculator. With depreciation two cars of the same car model can have different IDVs. A car insurance calculator is a very helpful online tool that helps you to calculate and figure out the insurance premium cost for your carvehicle.

Using a car insurance calculator helps save time. Basics of car value depreciation. Lowering the purchase price of a new car helps to lower the amount of depreciation of a car since it started at a lower price.

To calculate an auto lease you need to think about several factors. Its sometimes called a lease factor or even a lease fee. It instantly calculates the premium amount considering details such as cars make model RTO details Insured Declared Value IDV etc.

D P - A. The average used car price has surged close to 30 in recent years bringing the average transaction to 27633. Therefore the value of depreciation of accessories can influence the IDV on the basis of.

Price of the Car - the total amount the dealership is charging for this vehicle. To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1-year old etc. As the advocate of car buyers we believe that transparency is what consumers need and deserve and we have provided you just that.

The better approach is to expense a asset than to depreciation as the money has a time value. If you leave these blank we will use the following annual depreciation by year. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

This car depreciation calculator shows your car depreciation schedule year by year including Beginning Book Value Depreciation Percent Depreciation Amount Accumulated Depreciation Amount and Ending Book Value. In 2022 the average new car price exceeded 47000 and the median salary is 53924 for a full-time worker. The older the car will get the more the depreciation will be.

Before you blindly follow the calculator think about any non-monetary factors that might affect your decision. Get The App. Lease money factor In leasing the money factor is essentially the interest rate youll pay during your lease.

Car buyers can use these quotes to estimate competitive loan rates before dealing with an auto dealership in a negotation where the dealer has the upper hand and charges too high of an interest rate or tries to require unneeded extended warrany programs as. Residual Value how much this vehicle will be worth at the end of your. Input details to get depreciation.

Final value residual value - The expected final market value after the useful life of the asset. Say youre looking at two lease deals on similar cars. Input lines 1-9 of the calculator then follow these.

Car B has a 36-month lease with monthly payments of 185 and 3000 down. Buses - Charter Rental. Percentage Declining Balance Depreciation Calculator When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

The Car Depreciation Calculator uses the following formulae. Current Redmond Auto Loan Rates. Own years.

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Car Depreciation What Is It And How To Minimise It

Car Depreciation Online Tool For Philippines Carsurvey

A New Car Is Purchased For 38 000 And Over Time Its Value Depreciates By One Half Every 4 5 Years How Long To The Nearest Tenth Of A Year Would It Take For

Car Depreciation Calculator

Used Cars New Cars And Depreciation Auto City

The Depreciation League Table Different Countries Different Values Fleet Europe

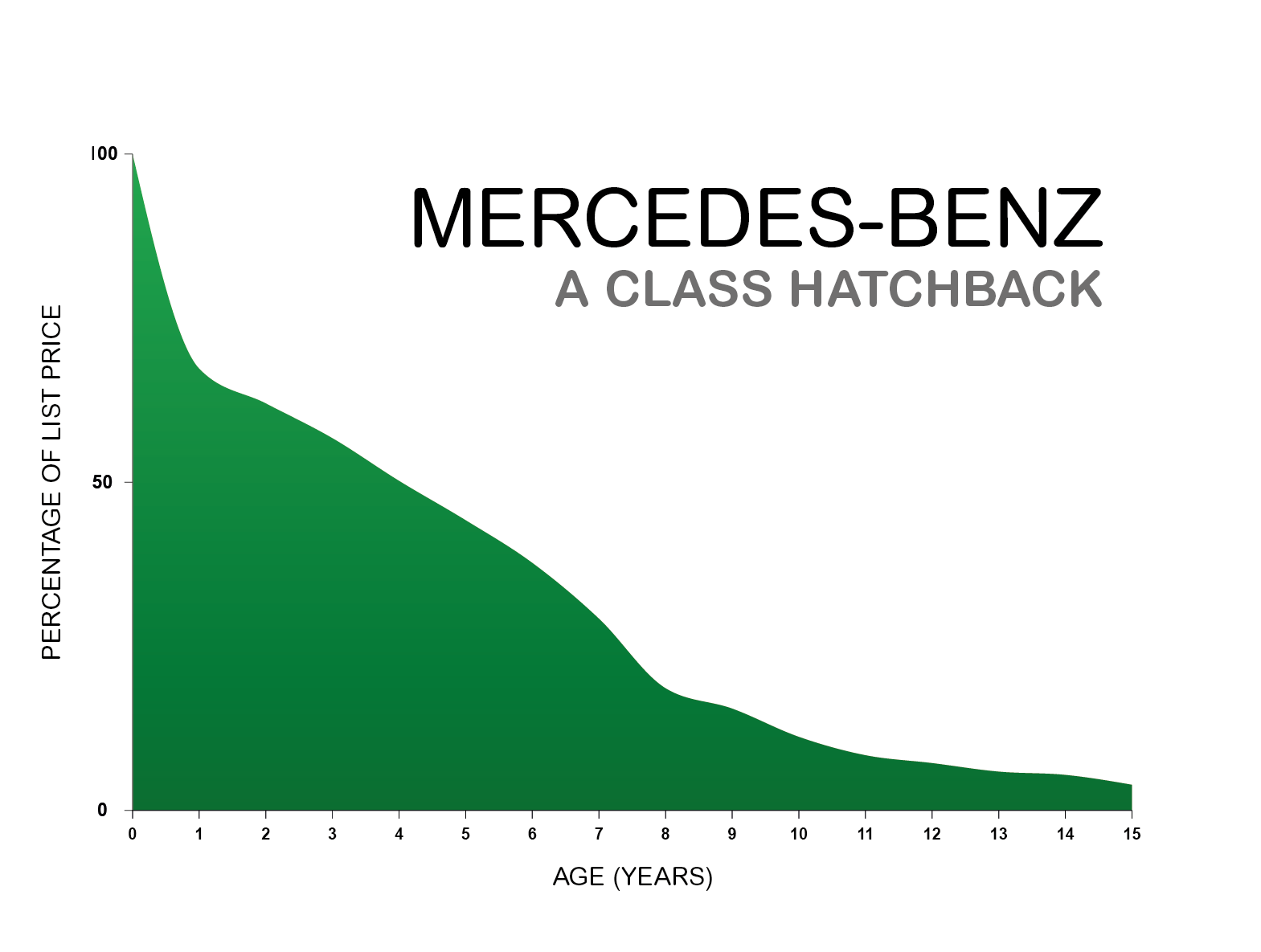

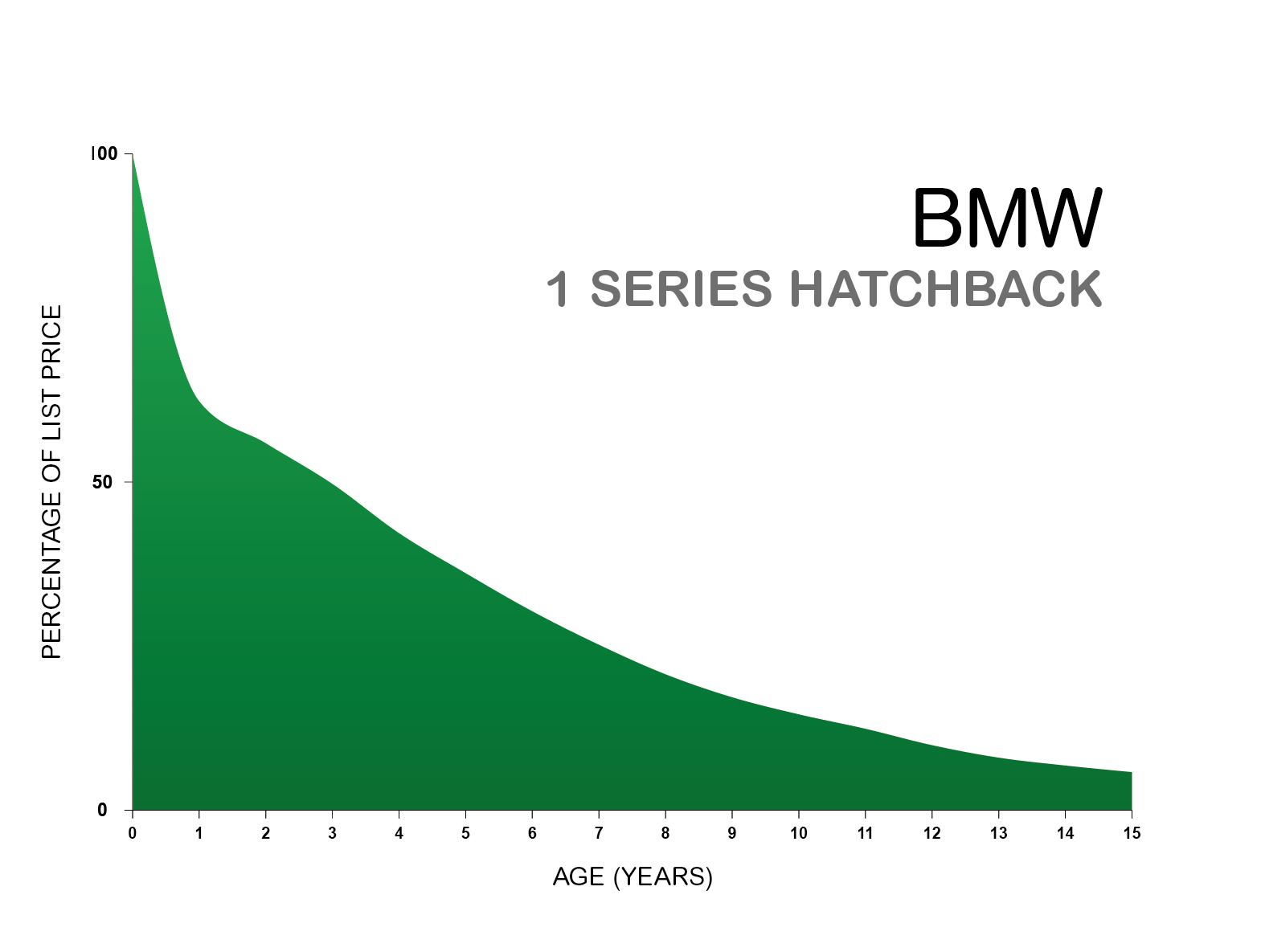

Car Depreciation Explained With Charts Webuyanycar

Annual Depreciation Of A New Car Find The Future Value Youtube

Car Depreciation Explained With Charts Webuyanycar

Car Depreciation How Much It Costs You Carfax

Car Costs Wikiwand

Car Depreciation Rate And Idv Calculator Mintwise

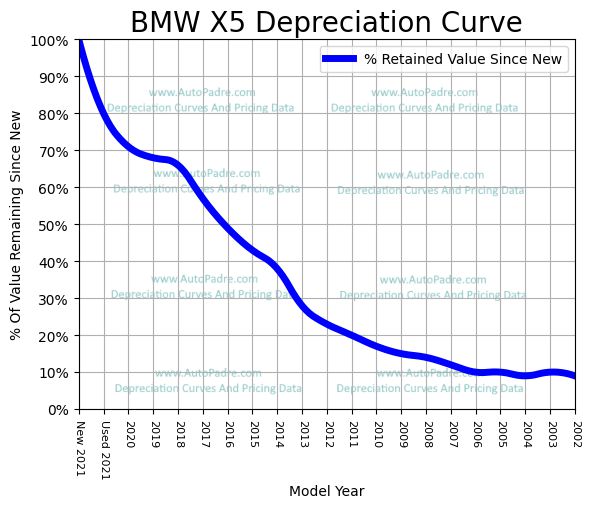

Bmw X5 Depreciation Rate Curve

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

Car Depreciation Calculator Finance Calculator Icalculator

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values